- cross-posted to:

- foss@beehaw.org

- cross-posted to:

- foss@beehaw.org

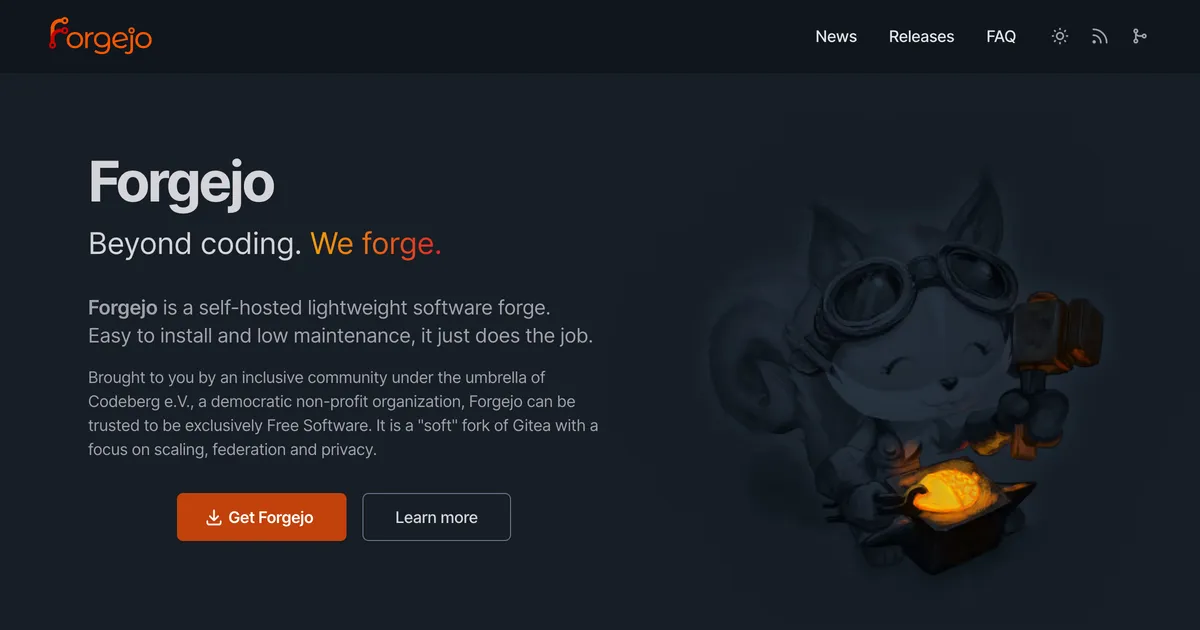

Forgejo is changing its license to a Copyleft license. This blog post will try to bring clarity about the impact to you, explain the motivation behind this change and answer some questions you might have.

…

Developers who choose to publish their work under a copyleft license are excluded from participating in software that is published under a permissive license. That is at the opposite of the core values of the Forgejo project and in June 2023 it was decided to also accept copylefted contributions. A year later, in August 2024, the first pull request to take advantage of this opportunity was proposed and merged.

…

Forgejo versions starting from v9.0 are now released under the GPL v3+ and earlier Forgejo versions, including v8.0 and v7.0 patch releases remain under the MIT license.

Let’s say I give $100,000 to a friend that starts a start-up. You claim after some years that investment is worth $1,000,000 and want me to pay $150,000 tax

I take out a loan for $150,000 because the startup didn’t make any profit. The startup goes bust. I now have a $100,000 loss and I paid $150,000 in taxes. Thankfully I can write $3000 off on my taxes every year until I die!

If the startup made no profit it would never be worth 1000000. You would only have a capital gain if value was realizable.

If you never made a dime from your initial 100000 investment you would sell off the asset at that point instead of paying taxes.

If you were too dumb to sell parts of your assets, and instead chose to be cash negative or fail to pay your taxes, you kind of deserve to lose everything because you were too stubborn to receive advice from anybody.

Amazon had its first profitable year in 2003. It was worth 21 billion dollars.

https://ycharts.com/companies/AMZN/revenues_annual

For reference

Did I say zero revenue? I said didn’t make a profit. Lots of companies made money, but couldn’t make more money than they spent. You can easily have an investment that is valued high that you can’t cash out

Let’s say you bought some stock now, at the end of the year it’s worth $1,000,000 and you get charged $150,000 in April. Big problem, the brokerages stopped allowing you to sell the stock and it crashed down, so now your GameStop stock is worth $100,000

How do you pay?

You don’t pay… This is a solved problem, wealth gain/loss would work the same way as capital gain/loss

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/personal-income/line-12700-capital-gains/capital-losses-deductions/you-use-a-capital-loss.html

It feels like people that don’t like this don’t actually know how to whole system is supposed to work.

Canada?!

Yes, but how much cashflow did it have, and how much in dividends did the individual stakeholders receive.

It never didn’t pay it’s taxes afaik

Edit: I’m fact checking myself, Amazon’s strategy is reinvesting all profits to support further growth. They were never in a position like the other poster is describing.

There were companies that didn’t survive the dot com crash despite being worth billions. Amazon is a company you would recognize, even though a better company is pets.com

If you bought their stock you would be very rich for a very short while until it went bankrupt