- cross-posted to:

- technology@lemmy.world

- cross-posted to:

- technology@lemmy.world

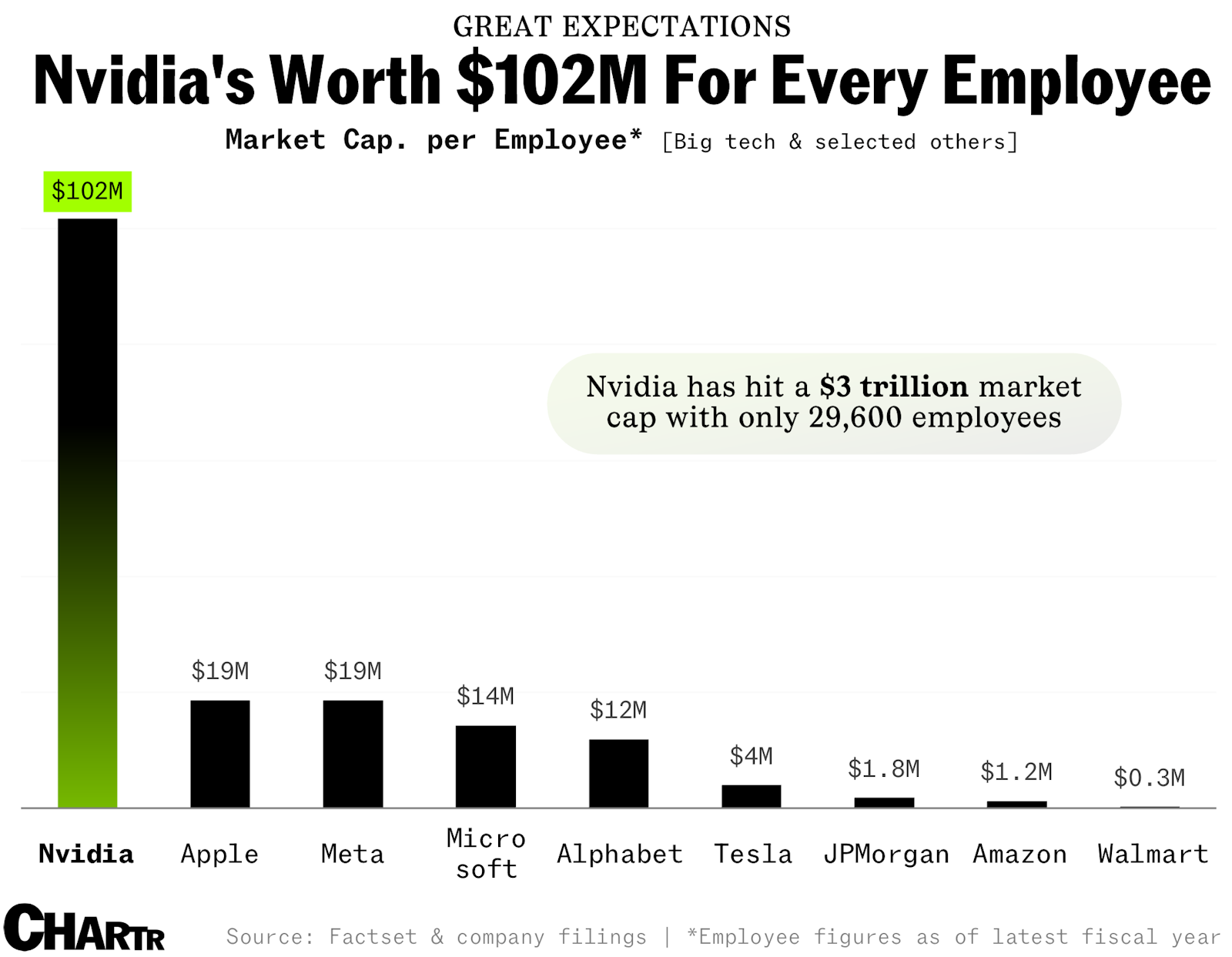

"…For Nvidia, after this latest run-up took it north of the $3T milestone, the company is being valued at more than $100M for each of its 29,600 employees (per its filing that counted up to the end of Jan 2024).

That’s more than 5x any of its big tech peers, and hundreds of times higher than more labor-intensive companies like Walmart and Amazon. It is worth noting that Nvidia has very likely done some hiring since the end of January — I think the company might be in growth mode — but even if the HR department has been working non-stop, Nvidia will still be a major outlier on this simple measure.

We are running out of ways to describe Nvidia’s recent run… but a nine-figure valuation per employee is a new one."

I don’t think many people would claim overall valuation has much of anything to do with the value labor brings to an organization.

In this case I think all it indicates is just how much the company’s stock price is driven by speculation about possible demand for generative AI, and even then I’m not sure that current price per share times number of shares divided by number of employees is a clear indication of that.

Apologies, can you clarify what exactly you mean by this? Because when I say their labour is not being valued, I do extend that to the Wall Street orgs that are doing the evaluations. They look at the “product” on offer, not the people actually working and developing it.

Are you saying because stock prices aren’t steady, we can’t correlate that to salaries?

With options trading, a lot of stock movement is reflective of speculation rather than true value.

Stock movement is always speculative with or without options. The difference that derivatives makes is the ability to price in speculative value at some point in the future as well. The price of a share is reflective of what traders think a company is worth today; but an option is a reflection of what traders think the shares will be worth at some point in the future, which people can then look at and use to re-adjust their estimation of what they think the underlying share price is worth today. It’s a recursive feedback loop that (theoretically) results in share prices closer approximating a true value. A sort of predictive smoothing function.

I’m saying that while a companies market capitalization is a real number that can tell you things about a company, it is not like anyone involved has a three trillion actual dollars. The company doesn’t see any of that money directly unless they directly issue more stock which would devalue the current stock, though there are some other ways for a company to use it to their advantage. Investors might be able to get a small percentage of that by selling, but only because someone else bought in with an equal amount of money, and a large sell will drive down the price.

More to the point, the evaluations people are doing with Nvidia don’t have much to do with what the company actually produces and puts out into the world today, but the assumption that it can turn its current leadership position in AI accelerator chip designs into growing massively in size in the future when every company needs a large data center or two to train their own individual LLM’s.

A individual stocks price is driven primarily by what people think that individual stock certificate can be sold for in the future, and effected by things like how many people are trying to sell, adding all of those certificates up at current market price doesn’t actually give anyone involved much information, nor does it reflect the actual quality, quantity, material, or labor taken to make things, in this case branded computer chip blueprints, that a company puts out into the world.

Now there are a lot of competing theories of ways to try and measure labor’s value, but my work being only as valuable as the speculative amount my organization as a whole might be theoretically sold for as a whole in the future if no one tries to undercut anyone else isn’t one of the more popular ones.

The company’s valuation in a public company reflects the price that people pay for shares, so it shows the value of the company on the open market. The employees created this value, so it does indicate how much they each created quite accurately. And you would think that they’d at least get a representative percentage of that at least. I mean if you paint a painting and someone pays $1m for it, you get $1m gross. You make the software and IP that’s sold for $100m and you only get $100k a year, that’s kinda wack.